Commodity

Commodity markets remain challenged at the beginning of 2016. Since the interim peak in 2014, the Bloomberg Commodity Index has fallen in five out of six quarters and the second half of 2015 proved to be particularly painful. The index has returned to the lowest level since 1999 thereby completely wiping out all the gains accumulated during the China-led emerging-market boom years.

Gold $1,000/oz flirtation

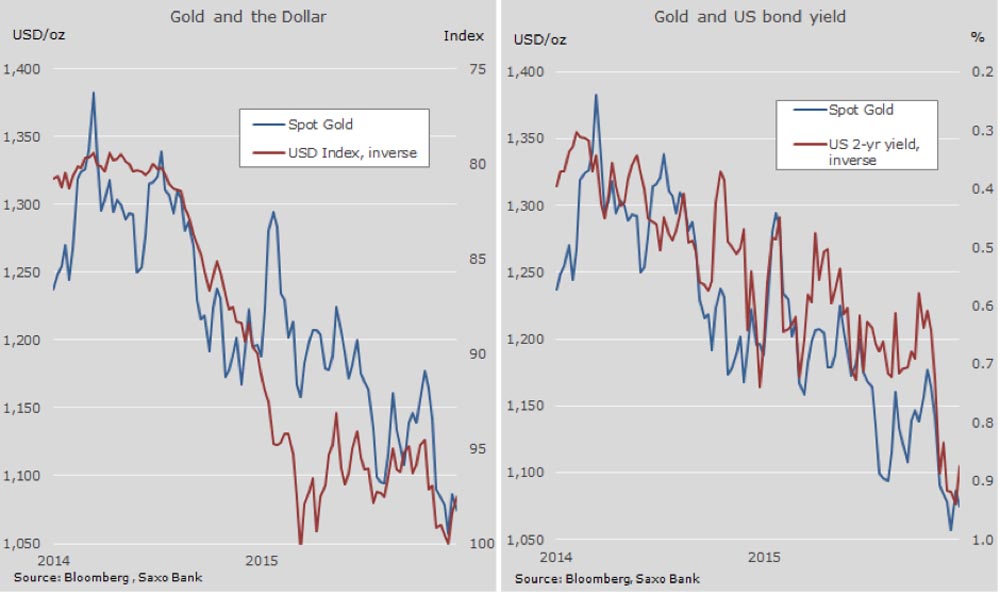

Much depends on the guidance that the Federal Open Market Committee will pass to the market over the coming months. The market’s projection of where US rates are heading are much less hawkish than the FOMC’s own projection so economic data will continue to be watched closely over the coming months.

The direction of the dollar, bond yields and inflation expectations will be the key drivers for gold and only when we see a change in current direction will investors begin returning to the yellow metal. On that assumption we see downside risk for gold during the first quarter but limiting it to $1,000/oz before eventually recovering and rallying towards $1,200/oz at the end of 2016.

by Ole S. Hansen - Head of Commodity Strategy

Pages

Click here to see the published article.