What to look for, if you are buying a vineyard

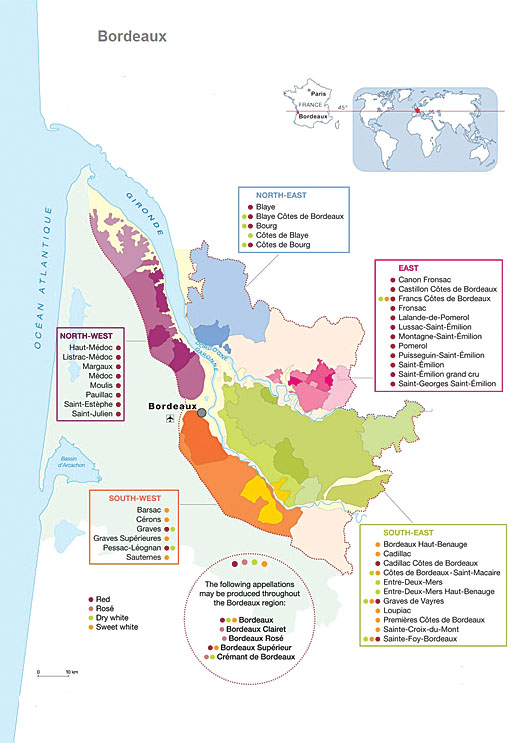

A vineyard at its core is an agricultural business. It may or may not come with a stately building or Château and winery. In fact, the St Emilion appellation has few impressive châteaux, yet its wines are mostly world class. Left bank properties, on the other hand, are larger and many feature a grand château at their heart.

A good starting point is to establish a clear set of objectives for the purchase. Is it lifestyle and prestige, business – vertical integration or site development? Or is it a combination?

Unlike some wine regions, most Bordeaux wines are blends. The winemaker and oenologist agree upon the cépage (blend) for a particular vintage. Then they can project how the wine will drink in four to 40 years, predicting the acid, tannins, alcohol, minerality and bouquet. All this requires deep understanding of the terroir and the vines. While assessing a vineyard, look into the experience of the winemaker and his team. Typically, winemakers are retained by new owners, though occasionally a new team is brought in with a change of ownership.

The vineyards are valued differently than other businesses. Given their specialised agricultural nature, It is difficult to extrapolate a steady revenue and profit growth for vineyards. Valuation is typically more skewed towards assets. Weightage of certain business components is then added to arrive at total valuation. Stock is usually valued and quoted separately. It is market practice for a new buyer to purchase most of the existing stock.

Vineyard ownership is a first step in a journey. It determines the direction you will travel in your pursuit of personal and/or professional route into winemaking. Enjoy the voyage.

Pages

Click here to see the published article.